Are vapers like you paying for lost tobacco revenue?

In interviews I’m often asked why, if vaping is 95% safer than smoking, there are so many negative stories around vaping.

My answer is that vaping is a disruptive industry which threatens more than US$700 billion in tobacco revenues and US$250 billion in tax revenues. It’s inevitable there’s going to be opposition to vaping.

But I’m always uneasy this may be interpreted as a conspiracy theory. So to illustrate the scale of the problem, we decided to put some data behind the assertion.

The results are astonishing. Not only is vaping costing billions in tax revenue, it could force some of the very states that have lead the charge against vaping into effective bankruptcy.

Let’s dive into the data.

Vaping and Tobacco Tax in the USA

We’ll start with tobacco revenues in the USA - not because they’re insignificant in the UK and the EU (as we'll see, the opposite is the case) but because that is where the majority of opposition to vaping seems to be originating.

At its peak in 2010 tobacco tax revenues reached 17.16 billion dollars. But that amount has been coming down rapidly as smokers quit or switch to alternative forms of nicotine - predominantly vaping. In 2018 projected revenues were 20% lower at 13.67 billion dollars. (Source: Statista).

So how is vaping affecting tax revenues?

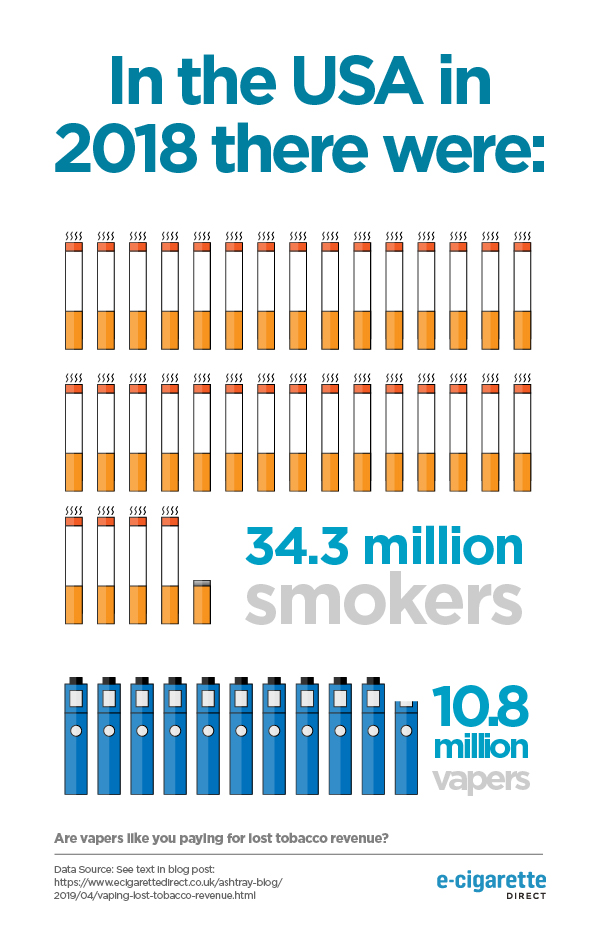

In 2018 there were 34.3 million smokers in the USA - and 10.8 million vapers, equivalent to almost 32% of the smoking population. If we divide total tax revenue by the number of smokers, we end up with $400 per smoker. Multiply that by the number of vapers and we get a total tax cost of $4.3 billion.

Of course, those are very rough figures. Some vapers people will be dual users (both vape and smoke), so will still be contributing towards some tobacco tax revenues, and of course there will be some taxes on vaping. But however you cut it, vaping is certainly costing the US government billions in lost tax revenues.

That sounds a lot, but does look insignificant when compared to the total US tax receipts, estimated to be $3.65 trillion in 2019. But things start to look a lot worse when we look at individual US states - and the bonds they have issued that are backed by tobacco revenues.

The Tobacco Master Settlement Agreement (MSA)

In 1997 tobacco companies agreed to pay 46 states more than 200 billion dollars over 25 years. The idea was to cover the cost of treating smoke related diseases, although in practice the money was often spent on other purposes. For example, one state chose to spend 75% of the total on tobacco production.

The largest recipient was California, which is to receive over 12% of the total amount. Remember that.

The amount is not set in stone, and one of the variants is the amount of cigarettes sold. The fewer cigarettes sold, the less money state governments receive, creating a perverse incentive to keep tobacco sales high.

(Intriguingly, if the sales of the tobacco companies in the agreement fall below that of companies not in the agreement, the states also get less money, creating a second perverse incentive to stifle competition.)

Crucially, while original estimates allowed for a slow decline in smoking rates, they did not allow for vaping, and vaping is not included in the master settlement agreement.

Now, if states had simply allowed the revenue to flow in, they would have faced a slow but steady decline in revenue from the tobacco master settlement.

Tobacco Secured Bonds and Looming Bankruptcy

Instead of waiting for the tobacco money up front, states sold bonds to investors. They promised to pay back these bonds using the money from tobacco settlement. Because of the guaranteed flow of money from the tobacco settlements, at the time investors considered these bonds a safe option.

But the states didn’t want to pay any interest at the start of the bonds. Instead, they wanted to allow the interest to roll up, kicking down the actual interest payments to later down the line. In return, they agreed to pay back many times the original amount borrowed.

How much? Well, in some cases payments are likely to be 76 times the initial payment. Millions in initial advances translated into billions of dollars in interest payments. And because the payments are so high, Moody’s estimates that 80% of the bonds are likely to default.

California is behind on its payments, while New Jersey has pledged its remaining 406 million dollars in tobacco revenue to rescue two bonds. In addition, New Jersey has had its credit rating downgraded, making it more expensive for the state to borrow money.

What happens if the bonds are not paid back? Unfortunately, they don’t go away. Bond holders have priority over taxpayers, and states have to foot the bill - and pay additional interest as a result.

And as for all the cash raised in the first place - well, for some states that’s long gone. David Rosseau, at the time Deputy Treasurer of New Jersey, admitted that:

“We basically burned it all in two years. It was not one of New Jersey’s better financial moves.”

Sources: Washington Post ^ California Debt & Investment Advisory Commission ^ Med Page Today

Funding Bad Publicity

While states in the US may be suffering from poor decisions around tobacco bonds, some of them are spending money on a campaign against vaping.

For example, while California is cash strapped, it did manage to find 75 million dollars to fund an award winning anti-vaping campaign with videos such as this one on teen vaping.

That’s been combined with extreme claims, including claiming that vaping will lead to the death of ‘hundreds of thousands of family members and friends’.

Bad Studies and More Bad Publicity

There’s also been a steady stream of bad science coming out of the USA.

These have included:

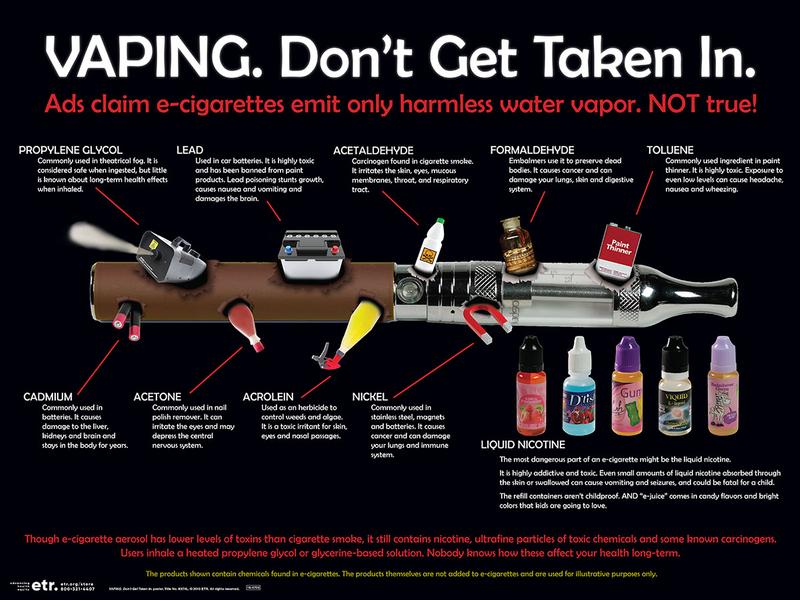

- maximising the wattage of an e-cigarette, burning the coil (rending it unusable for a vaper) and then measuring the formaldehyde

- exposing cells to nicotine 500 times the level found in cigarette smoke and vapour, and then expressing surprise when it was harmful

- measuring quit success rates with vaping using only existing smokers (i.e. excluding people who have quit smoking), and then saying that vaping doesn’t help you quit

We’ve covered a number of these studies, and what’s wrong with them, here.

All these studies and many more have been thoroughly debunked, a hugely time-consuming exercise which is eating up the time of scientists and researchers who I am sure would rather be carrying out their own research. Unfortunately, the alarming headline results are still released to the press and are often reported as fact.

The Irony of Cannabis Legalisation

Even more ironically, at the same time states are restricting vaping, they are legalising cannabis.

Whether or not you think it should be regulated, cannabis, when smoked, is likely to have a negative effect of health. After all, the harm from tobacco comes from combustion - the safest forms of oral tobacco carry a fraction of the risks of smoked tobacco. Inhale any smoke, tobacco, cannabis or something else entirely, and it's bad for you.

In contrast to vaping, states hope to make money from cannabis. In fact, according to the Mercury News, before legalisation California estimated it would make 1 billion dollars from marijuana annually. (The actual figure fell far short at 345 million dollars, less than it loaned to state departments to set up the legalised cannabis market).

Europe

Tobacco taxes are also a big source of revenue in the EU, with the sin tax bringing in around 70 billion euros in 2015. Based on this document, we estimate it’s now closer to 80 billion.

In contrast to the USA, tobacco tax revenues have remained relatively steady despite declining numbers of smokers. But that’s due to huge tax increases rather than steady sales. In 2008 Europe brought in 101.42 Euros per 1000 cigarettes sold - by 2015 it was 152.44. (Source: World Bank.)

It’s hard to get accurate figures of the number of vapers for the whole of Europe, but Reason.com estimates that by 2016 6 million vapers had used electronic cigarettes to stop smoking, while a further 9 million had used vaping to cut back. More recently, Japan Tobacco International estimated that there were approximately 40 million vapers in the world, with the potential to grow to around 110 million by 2025. With Europe having around 30% of the total, that would equate to around 12 million vapers currently.

That’s still small compared to the number of smokers in the EU. The population of the EU is around 512 million, and Europe estimates that around 26% of the population still smoke. That’s a massive 133 million people, who on average, according to the EU, will experience an average loss of life of 14 years.

Given that vapers are equivalent to around 9% of the total number of smokers, we could roughly estimate the decrease in tobacco revenue to be around 7.2 billion euros, with disclaimers as before (the inability to account for dual vapers, for people who have quit both smoking and vaping and the fact that there are more vapers in countries with high taxes on cigarettes.)

A brief mention here of health care. Health care tends to be pretty good in the EU, so of course governments to have to fork out for the cost of smoking diseases. But these are generally cheaper to treat than old age diseases (lung cancer is a much quicker killer than dementia). Smoking diseases also strike many smokers around about pensionable age, saving governments many billions in pension payments.

Of course, we can’t know if these concerns influence the EU. But we can look at what the EU has done and said.

The EU: Lobbying Itself For Stricter Vape Regulations

As long ago as 2013, MEPs were raising concerns about electronic cigarettes. Here's what one MEP asked:

“The consumption of traditional cigarettes provides the Member States with sizeable revenues, as a result of the substantial taxes to which they are subject… can the Council state what action it intends to take to address the differences in tax revenue materialising in State coffers following the proliferation of electronic cigarettes, which currently appear to be free from any form of duty?”

The EU commission went on to try and medicalise e-cigarettes (an effective ban, as at the time there were no electronic cigarettes with medical authorisation). Due in part to vigorous campaigning by vapers, this lead to the messy compromise that is the Tobacco Products Directive. Vaping has been restricted, but remains legal.

The EU has also held consultations on implementing vape specific taxes. I attended one of the consultations in London, and the EU representative actually posited tax as a positive factor for the vaping industry - on the basis that a standard EU vape tax could be a lot better than draconian taxes imposed by individual countries. A different stance is recorded in EU documents, where they appear to estimate that by harmonising duties on e-cigs, tobacco tax losses could be limited to 2.5% of total tax revenue. (Source: EU Commission Report).

So far these initial attempts have been thwarted. But that may not always be the case, and many in the industry think it’s only a matter of time before a vape tax is implemented.

It doesn’t help that in the EU there are 24 organisations pushing for tighter vape regulations.

Wonder where their funding is coming to fund lobbying the EU? According to International Vaping, in 2016 over 500 million euros of it came from the EU. So essentially, the EU is paying anti-vape organisations to lobby itself for tighter rules on vaping.

In conclusion

First, let’s give the UK government its dues. Vaping in the long term is likely to cost it considerable tax revenue (our current, very rough estimates are GBP 3.9 billion). But UK government body Public Health England, under leaders such as Martin Dockerell, has put health first, leading the world in its progressive stance towards vaping and reaping the results with a dramatic fall in both adult and youth smoking rates.

(Update: Unfortunately, that's now changed, with the UK government now planning one of the most expensive vape taxes in the world.)

But much of the rest of the world lags behind, and meanwhile on a daily basis people who are likely to die young from smoking are faced with a barrage of media stories asserting the dangers of vaping.

Could billions of dollars in tobacco taxes be one of the factors behind the attack on a disruptive industry? I’ll let you decide.